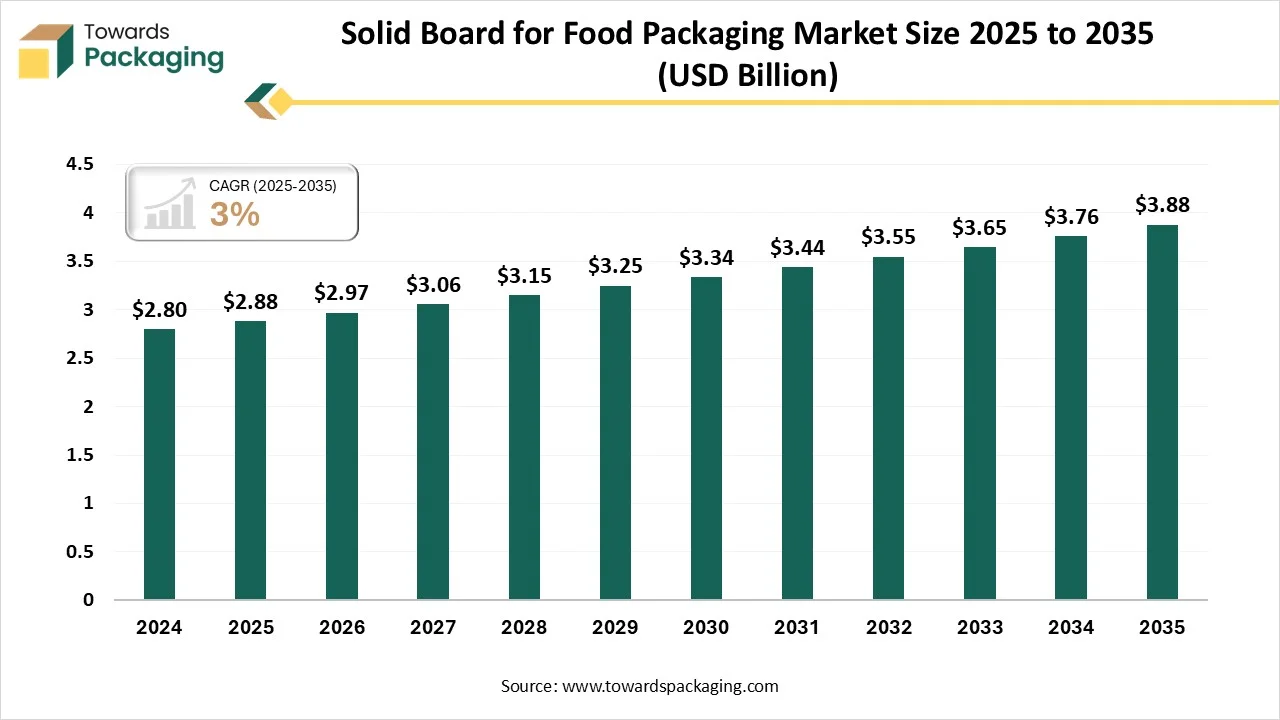

Ottawa, Jan. 30, 2026 (GLOBE NEWSWIRE) -- The global solid board for food packaging market reported a value of USD 2.88 billion in 2025, and according to estimates, it will reach USD 3.88 billion by 2035, as outlined in a study from Towards Packaging, a sister firm of Precedence Research.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

The solid board for food packaging market is witnessing steady growth, driven by rising demand for sustainable, recyclable, and rigid packaging solutions across the food industry. Solid board offers excellent strength, printability, and food safety compliance, supporting its use in frozen, bakery, and ready-to-eat foods.

What is meant by Solid Board for Food Packaging?

Solid board for food packaging refers to a dense, rigid paperboard material made from virgin or recycled fibers, designed to provide high strength, durability, hygiene, and excellent printability, ensuring safe protection, structural support, and premium presentation for packaged food products.

The growth of solid board for food packaging is driven by rising demand for sustainable and recyclable materials, increasing consumption of packaged and ready-to-eat foods, strong barrier and protection properties, premium packaging needs, regulatory pressure on plastics, and improved printing and coating technologies.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5917

Private Industry Investment for Solid Board for Food Packaging:

- Mondi plc: Finalised a $686 million acquisition of Schumacher Packaging’s assets in 2025 to scale up solid board production and digital printing for food brands.

- Smurfit Westrock: Completed a $34 billion merger in 2024 to consolidate global production of integrated, sustainable fiber-based food packaging.

- Graphic Packaging Holding: Invested $600 million in a state-of-the-art mill in Waco, Texas, to enhance the output of high-quality coated recycled board for food cartons.

- ITC Ltd: Allocated a significant portion of a $200 million capital expenditure plan specifically to expand paperboard capacity for the sustainable food market.

- Emami Paper Mills: Invested approximately $120 million into a multi-layered coated paperboard facility to target the growing demand for food and consumer goods packaging.

- Agrileaf: Raised nearly $2 million in seed funding in late 2024 to scale the manufacturing of biodegradable fiber-based trays and dinnerware for the food service industry.

What Are the Latest Key Trends in the Solid Board for Food Packaging Market?

1. Sustainability and Eco-Friendly Materials

One of the biggest trends in the solid board food packaging market is the strong shift toward sustainable and recyclable materials. Manufacturers and brands increasingly use solid boards made from recycled fibers or responsibly sourced pulp because consumers and regulators demand lower environmental impact and reduced plastic waste.

2. Advanced Barrier Coatings and Functional Performance

Solid boards are being enhanced with improved barrier coatings that significantly boost moisture, grease, and oxygen resistance, making them suitable for a wider range of food products, including fresh, refrigerated, and ready-to-eat items. These functional innovations extend shelf life, protect food safety, and expand board usage while maintaining recyclability.

3. Digital Printing and Custom Branding

Digital printing technologies on solid board packaging are becoming more popular as brands seek higher quality visuals, customization, and greater marketing impact. Enhanced print quality enables vibrant graphics, complex designs, and shorter production runs, helping food brands differentiate products on crowded store shelves and engage consumers more effectively.

4. Lightweighting and Right-Sizing Designs

Another major trend is lightweighting, designing solid board packaging that uses less material without sacrificing strength. This reduces material costs, transportation emissions, and waste, while also improving convenience for logistics and shelf stocking. Right-sized packaging optimizes space and reduces environmental footprint across the supply chain.

5. Retail-Ready and Shelf-Appeal Packaging

Solid boards are increasingly designed for retail-ready formats that enhance shelf visibility and simplify stocking. This includes point-of-sale displays, easy-to-open cartons, and packaging that highlights brand messages clearly at the retail level. These retail-oriented trends support stronger in-store performance and consumer engagement.

What is the Potential Growth Rate of the Solid Board for Food Packaging Industry?

The solid board for food packaging industry is expanding because multiple strong factors are driving its adoption and growth globally. First, there is a growing focus on sustainability and environmental responsibility as brands and regulators push for recyclable, biodegradable materials to replace plastics, which increases solid board demand due to its eco-friendly composition and recyclability. Consumer preference for green packaging and policies limiting plastic use are major contributors to this shift.

Government regulations advocating sustainable packaging solutions further encourage businesses to choose solid board. Second, the surge in e-commerce and online food delivery boosts the need for durable, protective packaging that ensures product safety during transit.

Third, technological advancements, such as improved barrier coatings, better strength, and high-quality printing capabilities, allow solid boards to meet food safety and branding requirements more effectively. Recent examples in 2026 include global food brands transitioning to recyclable paper packaging to reduce plastic waste, aligning with industry and consumer sustainability goals.

More Insights of Towards Packaging:

- Flexible Plastic Pouches Market Size and Segments Outlook (2026–2035)

- Battery Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Vaccine Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Advanced Coating for Healthcare Packaging Market Size and Segments Outlook (2026–2035)

- Polypropylene Disposable Food Containers Market Size, Trends and Regional Analysis (2026–2035)

- Packaging Resin Market Size, Trends and Competitive Landscape (2026–2035)

- Laminated Can Packaging Market Size, Trends and Segments (2026–2035)

- Electrostatic Discharge Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Biologics CDMO Secondary Packaging Market Size and Segments Outlook (2026–2035)

- Cartoning Machines Market Size and Segments Outlook (2026–2035)

- Vacuum Sealing Machine Market Size, Trends and Regional Analysis (2026–2035)

- Drugs Glass Packaging Market Size, Trends and Segments (2026–2035)

- Volatile Corrosion Inhibitors (VCI) Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Pharmaceutical Stand-Up Pouches Market Size, Trends and Segments (2026–2035)

- Tamper Evident Labels Market Size and Segments Outlook (2026–2035)

- High-Density Polyethylene (HDPE) Bottles Market Size, Trends and Competitive Landscape (2026–2035)

- Fertilizer Bag Market Size and Segments Outlook (2026–2035)

- Aseptic Processing and Packaging Market Size and Segments Outlook (2026–2035)

- Daily Chemical Product Stand Up Pouches Market Size, Share, Trends, and Forecast Analysis (2025-2035)

- Compostable Shrink Wrap Market Size, Trends and Competitive Landscape (2026–2035)

Regional Analysis:

Who is the leader in the Solid Board for Food Packaging Market?

Europe dominates the market because of strong environmental regulations reducing plastics, high consumer demand for sustainable and recyclable packaging, well-established food and beverage industries, and advanced manufacturing infrastructure.

Brand commitments to circular economy goals and early adoption of innovative barrier and printing technologies further strengthen Europe’s leadership, supported by widespread recycling systems and government incentives promoting eco-friendly packaging solutions across the region.

The UK Solid Board for Food Packaging Market Trends

The UK leads the European market because of strong environmental regulations, such as the Plastic Packaging Tax and Extended Producer Responsibility, which push brands toward recyclable paper-based packaging. UK consumers and major retailers increasingly prefer sustainable materials, while robust e-commerce and food sectors demand durable, recyclable board solutions. Advanced recycling infrastructure and innovation in sustainable material technologies further reinforce the UK’s dominant position in this segment.

How is the Opportunistic is the Rise of the Asia Pacific in the Solid Board for Food Packaging Industry?

The Asia-Pacific region is the fastest-growing in the market due to rapid urbanization and rising disposable incomes, which increase packaged food demand. Expanding e-commerce and food delivery sectors require durable, lightweight packaging that ensures product safety. Governments in countries like China, India, and Japan are enforcing stricter regulations on single-use plastics, pushing brands toward recyclable, paper-based solutions.

Additionally, growing consumer environmental awareness and investments in sustainable packaging technologies further accelerate regional adoption and innovation.

China Solid Board for Food Packaging Market Trends

China dominates the Asia-Pacific market because of its vast manufacturing capacity, strong domestic demand, and advanced packaging supply chain, supported by rapid growth in e-commerce and food sectors. Government policies promoting sustainable, recyclable materials and extensive production infrastructure enable China to scale solid board production efficiently and cost-effectively to meet both local and export demand.

How Big is the Success of the North American Solid Board for Food Packaging Industry?

North America’s success in solid board food packaging stems from strong sustainability initiatives, consumer demand for recyclable materials, and stringent regulations limiting plastics. Large food and beverage, retail, and e-commerce sectors drive demand for protective, eco-friendly board solutions. Continued innovation in barrier coatings, print quality, and manufacturing efficiency further strengthens adoption, meeting both environmental goals and performance requirements.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Segment Outlook

Board Type Insights

What made the Folding Boxboard (FBB) Segment Dominant in the Solid Board for Food Packaging Market in 2025?

The folding box board segment dominates because it offers excellent strength, printability, and versatility for high-quality food packaging. Its ability to support vibrant graphics and branding, combined with strong protective properties and compatibility with sustainable, recyclable materials, makes it ideal for premium and retail food products, boosting demand across various food categories.

The recycled solid board segment is the fastest growing because of increasing environmental awareness, stringent regulations against virgin plastics, and strong demand for sustainable, circular packaging. Brands and consumers prefer recycled materials to reduce waste and carbon footprint. Additionally, improvements in recycling technologies enhance performance, making recycled board suitable for a wider range of food packaging applications.

Coating/Treatment Insights

How the Virgin Coated Boards Dominated the Solid Board for Food Packaging Market in 2025?

The virgin-coated board segment dominates because it uses high-quality virgin wood pulp that delivers superior strength, uniformity, and a clean surface finish, making it ideal for food-safe contact and premium packaging. Its smooth, bright surface enhances printability and branding appeal, while certifications from sustainable forestry systems reassure manufacturers about responsible sourcing and product integrity.

The barrier-coated / laminated board segment is the fastest-growing because it provides enhanced moisture, grease, and oxygen resistance, making it suitable for a wider range of food products. Improved performance meets food safety standards, extends shelf life, and supports the shift from plastics to sustainable paper-based packaging, driving strong market demand.

Thickness Insights

Which Factors Make the Medium Boards (250–400 gsm) Segment the Dominant Segment in the Market in 2025?

The medium boards (252–400 gsm) segment dominates because it offers the ideal balance of strength, rigidity, and lightweight performance for diverse food packaging needs. Its durability protects products during handling and transport while remaining easy to print and fold, making it widely preferred by manufacturers for retail and consumer-oriented food packaging.

The heavyweight boards (>400 gsm) segment is the fastest growing because it delivers exceptional strength and rigidity for heavy or bulky food items, luxury packaging, and structural designs. Its superior durability enhances product protection, supports larger formats, and meets premium brand requirements, driving increased adoption across high-end and specialized food packaging applications.

End-User Insights

What made the Food & Beverage Manufacturers Segment Dominant in the Solid Board for Food Packaging Market in 2025?

The food and beverage manufacturers segment dominates the market due to high demand for safe, durable, and visually appealing packaging. Solid boards provide excellent protection, hygiene, and print quality, making them ideal for beverages, snacks, and ready-to-eat foods. Growing consumer preference for sustainable and recyclable packaging further boosts adoption in this segment.

The ready‑to‑eat or convenience food companies segment is the fastest growing because of rising consumer demand for quick, portable meals and increased on‑the‑go lifestyles. Solid board packaging offers excellent protection, easy handling, and strong shelf appeal, while supporting sustainability preferences, making it ideal for convenience foods that require safe, attractive, and eco‑friendly packaging solutions.

Recent Breakthroughs in Solid Board for Food Packaging Industry

- In November 2025, Babybel’s parent company, Bel Group, announced a major transition from traditional plastic cellophane to fully recyclable paper-based packaging for its snack cheeses across key markets. The shift reflects growing consumer demand for sustainable, eco-conscious packaging and aligns with global regulatory pressures on single-use plastics.

- In November 2025, global packaging leader Mondi unveiled its extended corrugated and solid board portfolio specifically designed for the food packaging sector. The launch emphasizes sustainability, offering recyclable and eco-friendly solid board solutions while enhancing digital print capabilities for high-quality branding and marketing.

- In April 2025, Mondi, a global leader in packaging company completed the acquisition of Schumacher Packaging, significantly expanding its production capacity and strengthening its supply network for solid board food packaging across Europe. The acquisition allows Mondi to better serve regional food and beverage manufacturers with innovative, sustainable packaging solutions.

Top Companies in the Global Solid Board for Food Packaging Market & Their Offerings:

- Sonoco Products: Produces recycled paperboard and rigid paper cans designed for dry food products like snacks and coffee.

- Graphic Packaging Holding: Specializes in folding cartons and fiber-based trays designed to replace plastic packaging for fresh and frozen meals.

- Huhtamaki: Manufactures folded carton food boxes and molded fiber containers for dairy, eggs, and fresh produce.

- Mondi plc: Provides high-quality solid board solutions for direct food contact and moisture-resistant packaging for frozen goods.

- DS Smith plc: Focuses on retail-ready solid board and corrugated solutions optimized for food transit and shelf display.

- Ball Corporation: Does not offer solid board; they specialize exclusively in aluminum cans and bottles for beverages and food.

- Amcor PLC: Offers specialty paper-based cartons with advanced barrier coatings for premium food and confectionery brands.

- International Paper: Supplies coated and uncoated paperboard used for food service items like cups, plates, and takeout containers.

- Smurfit Westrock: Delivers a vast range of solid board and corrugated packaging for everything from fresh produce to dairy and bakery items.

Segment Covered in the Report

By Board Type

- Folding Boxboard (FBB)

- Solid Bleached Sulfate Board (SBS)

- Coated Unbleached Kraft Board (CUK)

- Recycled Solid Board

By Coating / Treatment

- Virgin Coated Boards

- Recycled Coated Boards

- Barrier-Coated / Laminated Boards (for moisture/grease resistance)

By Thickness / Grade

- Lightweight Boards (<250 gsm)

- Medium Boards (250–400 gsm)

- Heavyweight Boards (>400 gsm)

By End-User Industry

- Food & Beverage Manufacturers

- Bakery & Confectionery Manufacturers

- Dairy Producers

- Ready-to-Eat / Convenience Food Companies

- Pharmaceutical & Nutraceutical Companies

North America:

- U.S.

- Canada

- Mexico

- Rest of North America

South America:

- Brazil

- Argentina

- Rest of South America

Europe:

Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5917

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

- Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | Justdial | Crunchbase | TrustPilot | Bizcommunity - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Healthcare Webwire | Packaging Webwire | Precedence Research Insights

Towards Packaging Releases Its Latest Insight - Check It Out:

- Biodegradable Packaging Materials Market Size, Trends and Segments (2026–2035)

- Hazardous Label Market Size, Trends and Segments (2026–2035)

- Advanced Packaging Market Size and Segments Outlook (2026–2035)

- Paint Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Sterile Medical Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Plastic Films and Sheets Market Size, Trends and Segments (2026–2035)

- Fiber-based Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Perforated Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Waterproof Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Pressure Sensitive Labels Market Size, Trends and Segments (2026–2035)

- Personal Care Stand-Up Pouches Market Size, Trends and Regional Analysis (2026–2035)

- Fresh Food Packaging Market Size and Segments Outlook (2026–2035)

- Centerfold Laminated Bag Market Size, Trends and Regional Analysis (2026–2035)

- Display Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Hazardous Waste Bag Market Size, Trends and Segments (2026–2035)

- Zero Waste Packaging Market Size, Trends and Segments (2026–2035)

- PET Containers Market Size and Segments Outlook (2026–2035)

- Chemicals Packaging Coding Equipment Market Size, Trends and Regional Analysis (2026–2035)

- Folding Cartons Market Size, Trends and Segments (2026–2035)

- Corrugated Fanfold Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2025-2035